Owner operators can make varying amounts after expenses, with net earnings dependent on factors such as operating costs, mileage, and load types. The average take-home pay for owner operators in Austin, Texas, can range from $50,000 to $150,000 annually, after deducting expenses such as fuel, maintenance, insurance, and taxes.

It is essential for owner operators to accurately track their expenses and manage their operations efficiently to maximize their earnings in the highly competitive trucking industry. By understanding and optimizing their cost structures, owner operators can achieve a profitable and sustainable business model.

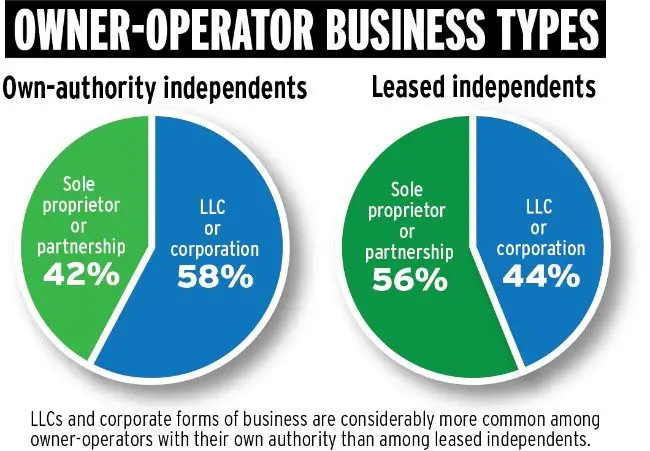

Credit: blog.projectionhub.com

Navigate As You Want:

Factors Affecting Owner Operator Earnings

Owner operator earnings are influenced by various factors such as location, type of trucking, operational costs, and experience level. Location plays a crucial role in earnings as rates can differ significantly across regions. The type of trucking also impacts income, with specialized freight often fetching higher rates. Operational costs, including fuel, maintenance, and insurance, directly affect earnings. Additionally, experience level can influence earnings as seasoned owner operators may have established relationships and negotiating power with clients. Understanding these factors is crucial for owner operators in devising strategies to maximize their take-home pay.

Calculating Net Income For Owner Operators

Calculating net income for owner operators involves subtracting expenses from their earnings. By properly calculating expenses such as fuel, maintenance, insurance, and permits, owner operators can determine how much they make after deducting these costs. The net income can vary depending on factors like location, type of trucking, and individual business expenses.

| Gross Revenue: Calculate total income earned. |

| Deducting Expenses: Subtract overhead costs from revenue. |

| Net Profit: Determine remaining earnings after expenses. |

Common Owner Operator Expenses

Owner operators have various expenses such as fuel, maintenance, insurance, and permits. After deducting these costs, their take-home pay depends on their miles, rates, and efficiency. Making a significant income as an owner operator requires diligent cost management and strategic business decisions.

- Fuel Costs: Owner operators need to budget for fuel expenses, which can vary based on distance traveled.

- Maintenance and Repairs: Regular maintenance and unexpected repairs can impact an owner operator’s earnings.

- Insurance: Owner operators must pay for insurance coverage, including liability and cargo insurance.

- Taxes: Owner operators are responsible for paying their taxes, including income taxes and self-employment taxes.

- Lease or Loan Payments: If an owner operator has a lease or loan for their truck, they need to factor in these payments.

Average Owner Operator Earnings

Industry Statistics: According to industry data, the average earnings of owner operators can vary significantly based on regional differences. In certain regions, such as Austin, Texas, United States, owner operators tend to earn higher incomes compared to other areas. Regional Differences: The location where an owner operator operates can have a significant impact on their earnings. Specialized Trucking: Owner operators who specialize in certain types of freight or services may command higher rates and therefore make increased earnings. Years of Experience: The amount of experience as an owner operator also plays a crucial role in determining their income levels. More experienced owner operators tend to earn higher incomes than those who are just starting out. Owner Operator Associations: Being a part of owner operator associations can provide valuable insights and resources that can contribute to greater earnings.

Tips For Maximizing Owner Operator Earnings

Maximize owner operator earnings by carefully tracking expenses. Calculate income after deducting fuel, maintenance, and insurance costs to optimize profitability. Monitor financial metrics regularly to ensure a lucrative business operation.

Negotiating Rates

- Research industry standard rates to have a benchmark

- Highlight your experience, reliability, and efficiency to negotiate higher rates

- Consider offering additional services to increase your value and negotiate better rates

Minimizing Expenses

- Regularly track and analyze your expenses to identify areas to cut costs

- Optimize fuel consumption by maintaining your vehicle properly and driving efficiently

- Shop around for the best insurance and maintenance deals

Implementing Efficient Routes

- Plan your routes in advance to avoid unnecessary mileage and tolls

- Use GPS and traffic monitoring apps to find the most time and cost-efficient routes

- Consider pooling resources with other operators to share routes and reduce expenses

Building And Maintaining A Strong Network

- Attend industry events and join professional associations to connect with other operators and potential clients

- Provide exceptional customer service to build a positive reputation and gain referrals

- Establish long-term relationships with reliable suppliers and clients for consistent work opportunities

Credit: www.statustransportationreviews.com

Credit: truckstop.com

Frequently Asked Questions For How Much Do Owner Operators Make After Expenses

How Much Do Owner Operators Keep After Expenses?

Owner operators keep an average of 25-30% of their gross revenue after expenses.

What Is The Gross Profit Of An Owner-operator?

The gross profit of an owner-operator is the revenue earned minus the operating expenses.

How Much Should Owner Operators Pay Themselves?

Owner operators should pay themselves based on their net profits after deducting all expenses.

How Much Can Owner Operators Write Off?

Owner operators can write off various expenses related to their business, including fuel, maintenance costs, insurance premiums, and truck lease or financing payments. However, the exact amount that can be written off will vary depending on individual circumstances. It is recommended to consult with a tax professional for accurate and personalized advice.

Conclusion

Owner operators are likely to make a substantial income after covering their expenses. By carefully managing costs and seeking higher paying contracts, owner operators can improve their take-home pay. However, it’s important to stay informed about industry trends and regulations to maximize profitability.

With dedication and smart decision-making, owner operators can enjoy a successful and lucrative career in the trucking industry.