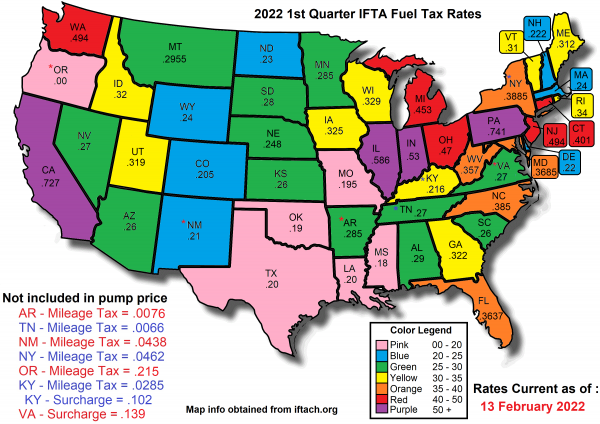

The cost of IFTA quarterly is based on fuel mileage and tax rates in each state. These factors determine the amount owed each quarter.

When it comes to managing a commercial fleet, understanding and budgeting for IFTA costs is essential. The International Fuel Tax Agreement requires interstate motor carriers to report fuel usage and pay taxes accordingly. Calculating IFTA costs quarterly involves determining fuel consumption in each state based on total miles driven and fuel mileage.

This process helps carriers stay compliant with tax regulations and avoids penalties for non-compliance. By accurately tracking and calculating IFTA costs, businesses can optimize their budgeting and financial planning for efficient fleet management.

Credit: blog.trucklogics.com

Navigate As You Want:

Understanding Ifta

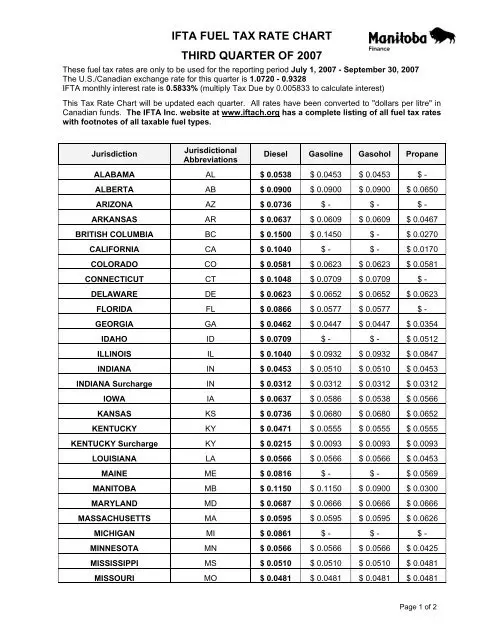

Understanding IFTA: IFTA, or the International Fuel Tax Agreement, is a cooperative agreement among U.S. states and Canadian provinces to simplify the reporting and payment of fuel taxes by interstate motor carriers. What is IFTA? It allows carriers to register and report fuel usage in multiple jurisdictions through a single base jurisdiction. This eliminates the need to obtain fuel permits for each state in which carriers operate. How does IFTA Fuel Tax Work? Carriers are required to file quarterly fuel tax reports, detailing miles traveled and fuel purchased in each jurisdiction. Taxes owed are calculated using a standard fuel tax rate and then reconciled against taxes already paid.

Calculating Ifta Tax

Calculating IFTA tax requires careful consideration of total miles driven in each state and the fuel consumed. By subtracting the fuel tax paid from the fuel tax required, you can determine the amount owed to each state. Stay on top of your IFTA mileage by recording odometer miles at state lines or refuels.

Cost Of Ifta

Calculating and reporting your IFTA costs quarterly can vary, with factors like fuel rates and miles driven in each state/province affecting the amount owed. It’s essential to keep accurate records to avoid overpayment and possible audits, ensuring compliance with IFTA regulations.

Tracking data manually or using specialized software can help streamline the process.

| How Much Does Ifta Cost Quarterly |

| Average cost of IFTA per quarter: – The cost of IFTA in Texas varies based on fuel consumption and tax rates. – In California, the cost of IFTA is influenced by distance traveled and fuel efficiency. |

Managing Ifta Mileage

Sure! Here is the response in HTML format:Managing IFTA Mileage: Keeping track of IFTA mileage is crucial for accurate reporting. It is important to accurately record mileage to ensure compliance with IFTA regulations. There are recommended methods for tracking mileage, such as using GPS tracking systems or manual entry in mileage logs. By tracking and documenting mileage accurately, you can avoid potential penalties and fines for inaccurate reporting.

How to keep track of IFTA mileage: One way to keep track of IFTA mileage is to use GPS tracking systems, which automatically record and track mileage. Another method is to manually record mileage in a mileage log. It is essential to track mileage for each state or province and accurately record fuel consumption to calculate IFTA tax obligations. This accurate recording of mileage is vital for maintaining compliance with IFTA regulations.

Resources For Ifta Reporting

Easily track IFTA reporting costs quarterly with available resources for precise calculations. Ensure accurate fuel tax reporting with odometer tracking and proper record-keeping methods. Simplify IFTA tax calculations with helpful online tools and guides.

Resources for IFTA Reporting – Trucker’s Guide for Completing IFTA Quarterly Tax Return Completing your IFTA quarterly tax return can be a complex process, but there are resources available to help make it easier. One helpful tool is the Free IFTA Calculator, which allows you to calculate your fuel tax owed by entering your total miles driven in each state/province and your overall fuel mileage. It then calculates the fuel consumed in each state/province and the fuel tax still owed to each state/province. Another useful resource is the State-by-State Mileage Calculator, which provides information on where to buy fuel for IFTA reporting. It is important to keep track of your IFTA mileage, and you can do this by keeping a notebook and pen handy to record your odometer miles every time you cross a state line or refuel. Understanding IFTA reporting is crucial for truckers, as it ensures compliance with tax regulations. By utilizing these resources, you can accurately calculate your IFTA tax and ensure that you are staying on top of your tax obligations.

Credit: www.truckingoffice.com

Credit: www.expeditersonline.com

Frequently Asked Questions On How Much Does Ifta Cost Quarterly

How Do I Manually Calculate Ifta?

To manually calculate IFTA, multiply total miles by fuel mileage for fuel consumed. Deduct tax paid from required tax for balance owed to each state.

How Much Does It Cost To Get An Ifta In California?

The cost to get an IFTA in California varies but typically involves a fee of about $8. You can verify the exact cost by contacting the California State Board of Equalization.

How Do I Keep Track Of My Ifta Mileage?

To keep track of your IFTA mileage, simply keep a notebook and pen handy. Write down your odometer miles every time you cross a state line or refuel. It’s also helpful to record your miles every time you stop, especially for audit situations.

What Is A Good Mpg For Ifta?

A good mpg for IFTA can vary depending on the vehicle and driving conditions. However, a general benchmark for good fuel efficiency is around 6 to 8 miles per gallon (mpg).

Conclusion

Understanding the costs and requirements of IFTA is essential for efficient quarterly tax reporting. By keeping track of mileage and fuel consumption, truckers can ensure accurate and timely filing, avoiding potential penalties. Staying informed and utilizing resources like IFTA calculators can streamline the process and alleviate the financial burden of non-compliance.