Apportioned plates in Texas are for vehicles registered under the International Registration Plan (IRP), which exempts them from motor vehicle tax if purchased in or out of state with fees apportioned into Texas. In Texas, vehicles registered with apportioned plates under the International Registration Plan (IRP) enjoy tax exemptions when purchased in Texas or out of state, with registration fees distributed into Texas.

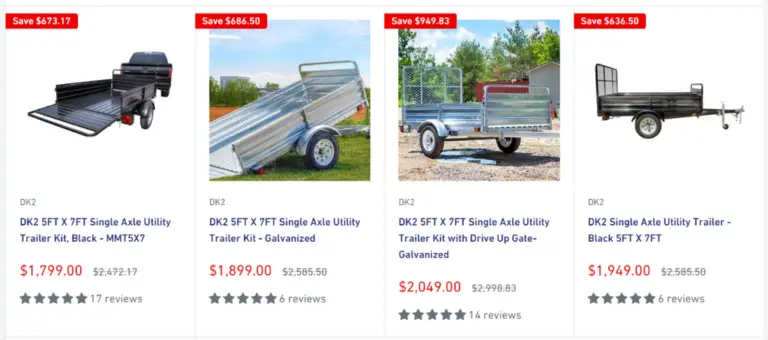

These plates are typically used for tractors, trucks, and truck tractors planning to operate in multiple jurisdictions under the IRP. Understanding the different types of license plates in Texas is crucial, as they fall into categories like General Issue, Specialty, and Souvenir plates.

Apportioned registration, also known as the IRP, provides commercial vehicles with registration credentials across jurisdictions, allowing interstate travel without the need for trip permits. The flexibility of apportioned plates benefits trucking businesses operating in multiple states while ensuring compliance with regulations.

Credit: fmcsaregistration.com

Navigate As You Want:

What Are Apportioned Plates In Texas

Apportioned plates in Texas are issued for commercial vehicles that operate in more than one jurisdiction. These plates are obtained through the International Registration Plan (IRP) and allow for interstate travel under a single registration. The purpose of apportioned plates is to streamline the registration process for companies with vehicles traveling in multiple states. To acquire apportioned plates, specific requirements such as proof of insurance, business identification, and payment of apportioned fees need to be met. The benefits of apportioned plates include the convenience of interstate travel without the need for trip permits, and exemption from certain state taxes. The process of obtaining apportioned plates involves registering through the IRP, providing necessary documentation, and obtaining validation tabs for the plates.

Credit: flexfleetrental.com

Credit: www.txdmv.gov

Frequently Asked Questions For What Are Apportioned Plates In Texas

Do You Pay Sales Tax On Apportioned Plates In Texas?

Apportioned plates in Texas are exempt from sales tax for vehicles registered under IRP.

What Are The Different Types Of Texas License Plates?

Texas license plates are categorized as General Issue, Specialty, and Souvenir plates for different vehicle registration purposes.

What Are Apportioned Plates In The Us?

Apportioned plates in the US are for trucking businesses traveling in multiple jurisdictions under the International Registration Plan (IRP). They are used for vehicles exceeding a certain weight limit and are subject to fees in each state where they operate.

What Does Irp Mean In Trucking?

The International Registration Plan (IRP) is a way to register commercial vehicles for interstate operation. It allows for a single registration plate and certificate issued by your “base” state. IRP is used by trucking businesses that operate in multiple jurisdictions and exceed a certain weight limit.

Conclusion

Understanding apportioned plates in Texas is crucial for trucking businesses. With IRP registration, commercial vehicles can operate interstate under a single plate. Obtaining registration credentials in one jurisdiction allows for seamless interstate travel. By complying with Texas regulations, trucking businesses can ensure a smooth and cost-effective operation across multiple states.