Semi truck insurance covers liability, physical damage, and cargo protection for commercial truck drivers. This type of insurance provides essential coverage for trucks, trailers, and their drivers, ensuring financial protection against accidents and unexpected incidents on the road.

Commercial truck drivers rely on semi truck insurance to protect themselves and their assets from potential dangers on the road. This specialized insurance provides coverage for liability in case of accidents or damage, physical damage to the vehicle, and protection for the cargo being transported.

The insurance is essential for ensuring financial security and peace of mind while operating commercial trucks. By understanding the coverage options and benefits of semi truck insurance, drivers can make informed decisions to safeguard their livelihood and assets.

Navigate As You Want:

Types Of Coverage

When you own a semi truck, it is crucial to have the right insurance coverage. Semi truck insurance covers various areas to protect you financially in case of any unfortunate event. There are different types of coverage you need to consider.

Primary Liability: Primary liability insurance is the most basic coverage that all truckers are required to have. It covers the damage you may cause to another person or their property while operating your truck.

Physical Damage: Physical damage coverage protects your truck from damages caused by accidents, theft, or vandalism. It includes both collision coverage, which pays for damages from collisions, and comprehensive coverage, which covers damages from other incidents.

Cargo Insurance: Cargo insurance covers the goods you transport in case they are damaged, stolen, or lost during transit. It provides coverage for various types of cargo and ensures that you are protected financially.

Bobtail Insurance: Bobtail insurance covers your semi truck when you are driving without a trailer. It provides liability coverage during non-business use and protects you from potential risks even when you are not under a contract.

Primary Liability Coverage

Semi truck insurance covers the cost of damages and injuries resulting from accidents involving semi-trucks. It includes primary liability coverage, which is mandatory for all commercial vehicles. This type of coverage pays for bodily injury and property damage caused by the semi-truck. The definition of primary liability coverage is the legal responsibility of the trucking company or owner-operator for any bodily injury or property damage that occurs as a result of an accident involving their truck.

The coverage details usually include medical expenses, legal fees, property damage, and bodily injury claims. The limits and requirements for primary liability coverage vary by state and are set by the Federal Motor Carrier Safety Administration (FMCSA). It is essential for trucking companies and owner-operators to understand the specific limits and requirements in their operating areas to ensure compliance and adequate protection.

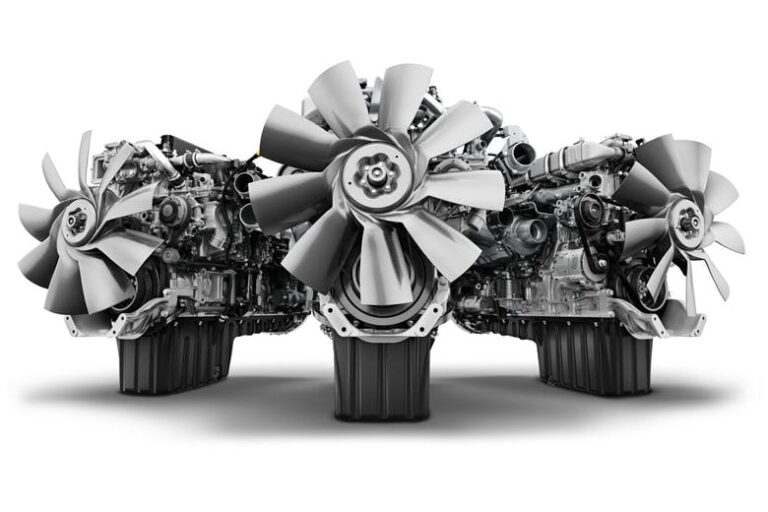

Physical Damage Coverage

Semi truck insurance cover includes physical damage coverage that protects your vehicle from accidents, theft, and other non-collision incidents.

Under physical damage coverage, the policy covers damages such as collision, vandalism, and falling objects. However, it’s essential to understand the details of the coverage, including deductibles and limits.

Various factors affect the premiums of the physical damage coverage, like the value of the truck, the driver’s history, and the nature of business operations.

Credit: www.truckinsurancenitic.com

Cargo Insurance

Semi truck insurance is a comprehensive policy that provides coverage for various aspects of running a trucking business. One important aspect is cargo insurance. Cargo insurance protects the goods being transported in case of damage or loss. It is essential to understand the definition and coverage details of cargo insurance. Cargo insurance reimburses the trucking company for the value of the goods in case of damage or loss during transit. This coverage is applicable to goods that are being transported by the insured trucking company. However, there are also common exclusions to cargo insurance coverage. Some of the common exclusions include perishable goods, hazardous materials, and illegal cargos. It is crucial to have a clear understanding of these coverage details and exclusions to ensure proper protection for the cargo being transported.

Bobtail Insurance

Bobtail insurance is a type of trucking insurance coverage that provides protection when a semi-truck is being operated without a trailer attached. It is also sometimes referred to as non-trucking liability insurance or deadhead coverage. This coverage is important for owner-operators and drivers who may be operating their trucks for personal use or during off-duty hours. Bobtail insurance typically applies when the truck is not under dispatch or carrying any cargo for a motor carrier. It provides liability coverage for accidents that may occur during these periods. The coverage details of bobtail insurance can vary depending on the insurance provider, but typically include bodily injury and property damage liability. It is important for truckers to ensure they have the appropriate bobtail insurance coverage to protect themselves and their vehicles when not actively hauling a load.

Credit: www.forerunnerinsurance.com

Credit: patruckinsurance.com

Frequently Asked Questions On What Does Semi Truck Insurance Cover

What Does Semi Truck Insurance Cover?

Semi truck insurance covers a range of potential risks and damages associated with operating a semi truck. It typically includes liability coverage for bodily injury and property damage, as well as coverage for collision, theft, fire, and vandalism. Some policies may also provide coverage for cargo and medical expenses.

Does Semi Truck Insurance Cover Accidents?

Yes, semi truck insurance typically covers accidents. It provides liability coverage for bodily injury and property damage caused by your truck. Additionally, collision coverage can help pay for damages to your truck if it is involved in an accident. However, coverage may vary depending on your specific policy and circumstances, so it’s important to review your coverage details.

Is Cargo Covered By Semi Truck Insurance?

Some semi truck insurance policies offer coverage for cargo. This coverage helps protect the value of the cargo being transported in case of damage or loss. It can provide compensation if the cargo is stolen, damaged in a collision, or lost due to other covered events.

However, it’s important to review your policy to understand the specific coverage for cargo.

How Much Does Semi Truck Insurance Cost?

The cost of semi truck insurance can vary depending on various factors like the type of truck, its value, your driving history, the coverage limits you choose, and the location where the truck operates. On average, you can expect to pay several thousand dollars per year for semi truck insurance.

It’s recommended to get quotes from multiple insurance providers to find the best coverage options at competitive prices.

Conclusion

In a nutshell, semi-truck insurance is essential for protecting your business and livelihood. It covers a wide range of potential risks, from accidents to cargo damage, providing financial security and peace of mind. Understanding what your policy includes and excludes is crucial to ensure complete coverage.

By working closely with a knowledgeable insurance agent, you can tailor a policy that meets your specific needs. So, get the right semi-truck insurance on your side and navigate the road ahead with confidence.