To get cheap semi truck insurance, compare quotes from multiple insurers online or through a broker, and choose a higher deductible to lower your premium. Finding affordable coverage for your semi truck can save you money in the long run, allowing you to allocate your financial resources to other aspects of your business.

As a truck owner, managing operational costs is crucial, and getting affordable insurance is a significant part of the equation. By understanding the factors that influence insurance costs and shopping around for the best deals, you can effectively reduce your expenses.

This article will delve into the strategies you can use to secure cheap semi truck insurance, empowering you to make informed decisions and optimize your budget without compromising on coverage.

Credit: masstransins.com

Navigate As You Want:

Researching The Insurance Market

When researching the insurance market for cheap semi truck insurance, it is crucial to identify potential insurance providers and compare multiple quotes. Begin by searching online and making a list of different companies that offer insurance for semi trucks. Take note of their reputation, customer reviews, and the types of coverage they offer. This step will help you identify reputable insurance providers that specialize in providing affordable coverage for semi trucks.

Next, reach out to these providers and request quotes specific to your needs. Be prepared to provide information about your semi truck, such as its make, model, year, and any safety features it has. Comparing quotes from different providers will enable you to compare coverage options and pricing. Consider the coverage limits, deductibles, and additional services included in each quote.

Once you have collected several quotes, carefully review each one to determine which provider offers the best value for your specific requirements. Keep in mind that the cheapest option may not always provide adequate coverage, so it is important to strike a balance between affordability and comprehensive protection for your semi truck. By conducting thorough research and comparing quotes, you can find the best deal on cheap semi truck insurance that meets your needs and budget.

Credit: www.truckinsurancenitic.com

Evaluating Coverage Options

|

In evaluating semi truck insurance options, it’s crucial to determine the required coverage based on the specific needs of your business. Consider opting for optional add-ons such as cargo insurance or motor truck general liability to provide comprehensive protection. |

Reducing Risk Factors

Maintaining a clean driving record is crucial for obtaining affordable semi truck insurance. Avoiding accidents and traffic violations is key. Investing in safety equipment such as dash cams and GPS tracking devices can also demonstrate a commitment to safety.

Optimizing Insurance Discounts

One of the most effective ways to get cheap semi truck insurance is by optimizing insurance discounts. Bundling policies is a great way to save money on your insurance premiums. By combining multiple policies with the same insurance provider, such as truck insurance, liability insurance, and cargo insurance, you can often receive a lower overall premium. Additionally, participating in safety programs can also help you qualify for discounts. Many insurance companies offer discounts to truckers who complete safety training courses or have installed safety equipment on their trucks. These programs not only help you save money on insurance, but they also promote safer driving habits, reducing the risk of accidents and claims. By taking advantage of these strategies, you can find affordable insurance coverage for your semi truck.

Negotiating With Insurance Providers

When negotiating with insurance providers for cheap semi truck insurance, it is important to leverage competition to your advantage. Start by gathering multiple quotes from different providers to compare rates and coverage options. Once you have this information, you can use it as a bargaining tool to negotiate better deals.

Highlight any additional discounts or incentives that other providers are offering, as this will put pressure on your current provider to offer you a competitive rate. For example, if another insurance company is offering a discount for insuring multiple vehicles, mention this to your current provider and inquire if they can match or beat that offer.

If there are any specific features or modifications on your semi truck that can reduce the risk, make sure to highlight those as well. This may include safety features such as anti-theft devices or GPS tracking systems. By demonstrating that your truck is equipped with these safety measures, you may be able to negotiate a lower insurance premium.

Remember to stay persistent and confident throughout the negotiation process. By leveraging competition and seeking additional discounts, you can increase your chances of getting cheap semi truck insurance without compromising on coverage.

Credit: www.socaltruckins.com

Frequently Asked Questions For How To Get Cheap Semi Truck Insurance

How Can I Find Affordable Semi Truck Insurance?

To find affordable semi truck insurance, it’s important to compare quotes from different insurance providers. Look for companies that specialize in commercial truck insurance and consider factors like your driving record and the age of your truck to get the best rates.

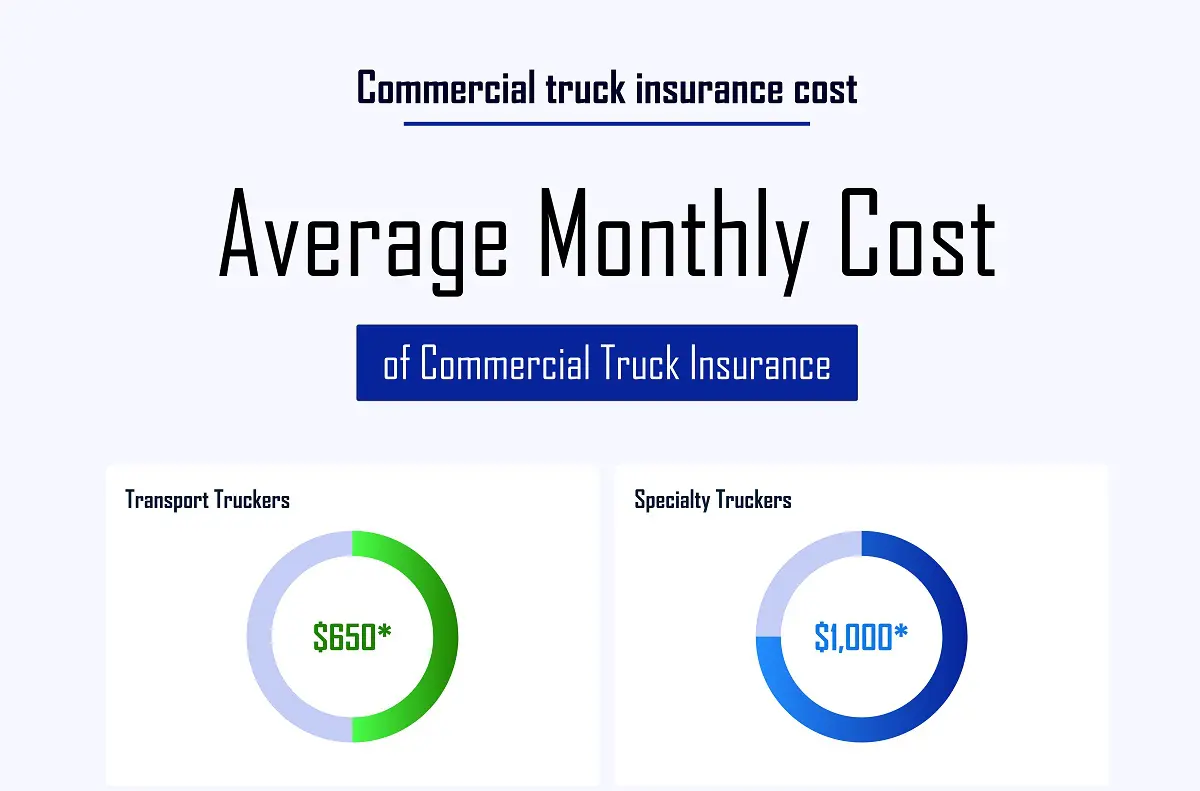

What Factors Influence The Cost Of Semi Truck Insurance?

Several factors can affect the cost of semi truck insurance, including the driver’s age and experience, the type and age of the truck, the desired coverage limits, and the intended use of the vehicle. Maintaining a clean driving record and taking steps to improve truck security can also help lower insurance costs.

Are There Any Specific Discounts Available For Semi Truck Insurance?

Yes, many insurance companies offer specific discounts for semi truck insurance policies. These discounts can vary between providers, but common ones include discounts for safe driving records, multiple policies, and fleet discounts for insuring multiple trucks with the same company.

Work with an insurance agent to identify eligible discounts for your specific situation.

What Types Of Coverage Should I Consider For My Semi Truck Insurance?

When considering semi truck insurance, it’s important to evaluate the coverage options that best protect you and your business. Comprehensive, collision, liability, and cargo coverage are common types that may be required or recommended. Discuss your needs with an insurance agent to determine the appropriate coverage for your specific situation.

Conclusion

Finding cheap semi truck insurance doesn’t have to be a daunting task. By following the tips and strategies outlined in this blog post, you can save money on your insurance premiums without compromising on coverage. Remember to compare quotes from multiple insurers, maintain a clean driving record, and take advantage of available discounts.

With a little research and effort, you’ll be on your way to getting affordable semi truck insurance that fits your needs and budget.